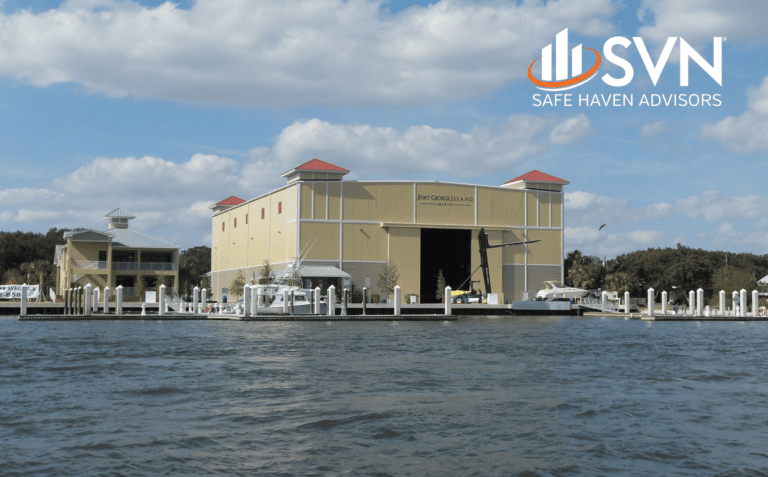

Jacksonville, FL Jupiter, FL — SVN | Safe Haven Advisors, a specialty marina & marine business advisory practice, hasarranged the sale of Fort George Island Marina in Duval County, FL to Yamaha Motor CorporationU.S.A. Coordinating the sale on behalf of the buyer was David Kendall, a founding partner of SVN | SafeHaven Advisors. Fort George…

Read MoreSt. Augustine Marine Center St. Augustine, FL (June 26, 2023) – SVN | Safe Haven Advisors is pleased to announce it has advised the Windward Marina Group (“Windward”) on the sale of the St. Augustine Marine Center (“SAMC”) to the Monument Marine Group. Windward acquired SAMC in 2018 and transformed the operation into a world-class…

Read MoreTransaction includes “The Point Grill and Bar” Jupiter, FL (May 15, 2023) – SVN Safe Haven Advisors is pleased to announce it has advised the owner of Paradise Point Marina and RV Park on the sale of its marina, restaurant and RV Park located on Lay Lake in Columbiana, AL. The acquirer of the property…

Read MoreMany of the Marina & Marine business owners we work with do not employ optimal tax planning prior to selling their real estate and business assets. For that reason, we have joined with The Estate Planning Team to introduce a pre-packaged solution, called a Deferred Sales Trust™, to defer capital gains taxes when selling real…

Read MoreKendall was among 157 individuals who earned commercial real estate’s global standard for professional achievement. Chicago (October 14th, 2022) – David Kendall, Managing Director of SVN | Safe Haven Advisors and founding member of SVN Marinas, recently received the Certified Commercial Investment Member (CCIM) designation from CCIM Institute. The designation was awarded during this year’s fall…

Read MoreBUFORD, Ga., Aug. 24, 2022 (GLOBE NEWSWIRE) — OneWater Marine Inc. (NASDAQ: ONEW) (“OneWater” or “the Company”) announced today that it has reached an agreement to acquire Taylor Marine Centers, which will further expand the Company’s presence in the Mid-Atlantic U.S. and enhance new and pre-owned boat sales, finance, and parts and services offerings. The…

Read MoreCLEARWATER, Fla.–(BUSINESS WIRE)–MarineMax, Inc. (NYSE: HZO), the world’s largest recreational boat and yacht retailer, today announced that it has entered into a definitive agreement to acquire Island Global Yachting LLC (“IGY Marinas”), which owns and operates a collection of iconic marina assets and a yacht management platform in key global yachting destinations. MarineMax will acquire…

Read MoreOneWater Marine today announced it reached an agreement to acquire Denison Yachting. “We are thrilled to welcome Bob Denison and his team into the OneWater family, which expands and strengthens our presence in the superyacht and yacht categories,” OneWater CEO Austin Singleton said in a statement. “As we move through the second fiscal quarter, we continue…

Read MoreMarine and powersports dealer Power Lodge acquired Miller Marine in St. Cloud, Minn. Power Lodge owner Tom Dehn announced the sale in a statement. Miller Marine is the world’s largest seller of high-performance Bennington pontoons and is one of the largest single-point boat dealerships, the statement said. It was once named the No. 1 Yamaha outboard dealer…

Read MoreTopSide Marinas has acquired North Point Yacht Club on Lake Belton in Texas. TopSide plans to invest in the Temple, Tex., marina by adding more than 70 wet slips, TopSide cofounder Jacob Boan said Tuesday in a statement. The property, previously owned by the Brashear family, is TopSide’s third marina. “The Brashear family has always wanted…

Read More